rhode island state tax withholding

RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI. The more you withhold the more frequently youll need to make withholding tax payments.

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

505 Tax Withholding and Estimated Tax.

. If you meet both of the conditions below you may claim exemption from Rhode Island withholding for 2021. However if Annual wages are more than 231500 Exemption is 0 Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. The Rhode Island tax liability before any withholding or credits is 800 and his tax liability to State X before.

Withholding and when you must furnish a new Form W-4 see Pub. Call 401 574-8484 if you have any questions. Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer.

Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. A Last year I had a right to a refund of all Rhode Island income tax withheld because I had notax liability AND b This year I expect a refund of all Rhode Island income tax because I expect to havenotax liability. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions.

QUARTERLY see section 6 of these instructions. The income tax withholding for the State of Rhode Island includes the following changes. The income tax withholding for the State of Rhode Island includes the following changes.

Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. The amount to be withheld may be calculated using the percentage method provided by the Division of Taxation. Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

2022 Filing Season FAQs - February 1 2022. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. We allow for estimated payments extension payments payments with a tax filing license renewal payments bill payments and payments for various fees.

A person is domiciled outside Rhode Island but is living in a home maintained by him in Rhode Island for more than 183 days of the tax year and therefore is considered a resident for the personal income tax purposes of this state. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. RI Division of Taxation - 401-574-8829 - sales tax questions Do you need a permit to make sales at retail.

If the employers average Rhode Island withholding for the previous calendar year is 200 or more per month the employer is required to file and remit the monthly withholding tax by electronic means or be penalized. PPP loan forgiveness - forms FAQs guidance. Divide the annual Rhode Island tax withholding by 26 to obtain the biweekly Rhode Island tax withholding.

Technical Problems with the online application - 401-831-8099. Rhode Island employer means an employer maintaining an office or transacting business within this state. The income tax wage table has been updated.

You may claim exemption from withholding for 2022 if you meet both of the following conditions. The table below shows the income tax rates in Rhode Island for all filing statuses. Up to 25 cash back In Rhode Island there are five possible payment schedules for withholding taxes.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the difference. The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750.

State Taxes State Of Rhode Island Rhode Island Division Of Taxation Ri Gov State Income Tax Withholding Considerations A Better Way To Blog Paymaster Paying Social Security Taxes On Earnings After Full Retirement Age. Rhode Island Taxable Income Rate. TAXES 21-18 Rhode Island State Income Tax Withholding.

The sales tax is imposed upon the retailer at the rate of 7 of the gross receipts from taxable sales. Withholding Tax Forms All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970 Withholding tax forms now contain a 1D barcode. The income tax withholding for the State of Rhode Island includes the following changes.

Martha Martinez a nonresident is selling property in Rhode Island and 20 days before the closing elects the gain method of withholding by computing the RI 713 Election form and sending it to the Division of Taxation. Rhode island income tax withholding Sunday May 8 2022 Edit. Please use Microsoft Edge browser.

The income tax wage table has changed. March 30 2021 Effective. Employers must withhold state income taxes at the time of each wage payment.

No action on the part of the employee or the personnel office is necessary. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1. You had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022.

The definition of wages under Rhode Islands law is the same as for federal tax purposes. 248250 plus 475 of excess over 66200. If you need help getting started feel free to call us at 4015748484 or email at taxportaltaxrigov.

Masks are required when visiting Divisions office. For more information please refer to the instructions provided by your. More Payroll Information for Rhode Island Small Business.

Daily quarter-monthly monthly quarterly and annually. Read the summary of the latest tax changes. The retailer or vendor must collect tax from their customers which must be remitted directly to the state.

In addition to the sales tax there is also a 6 hotel tax on the rental of rooms in hotels motels or lodging houses. A Rhode Island employer must withhold Rhode Island income tax from the wages of an. RI Division of Taxation - Employer Tax Section - 401-574-8700 Option 2.

Pay Period 06 2021. Latest Tax News. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

Rhode Island employer means an employer maintaining an office or transacting business within this state.

Tax Withholding For Pensions And Social Security Sensible Money

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State W 4 Form Detailed Withholding Forms By State Chart

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

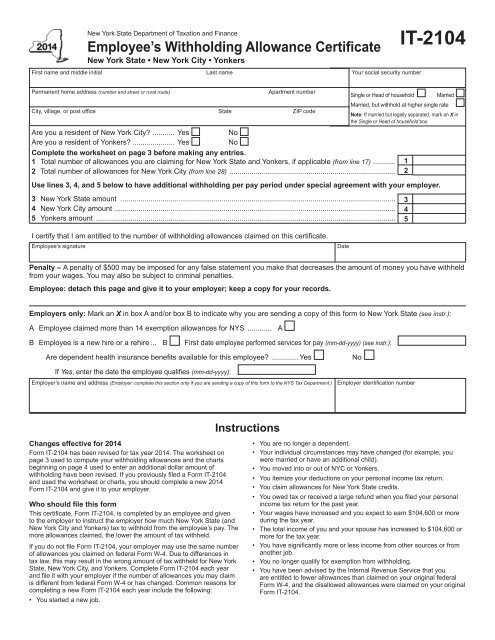

Form It 2104 New York State Tax Withholding South Colonie

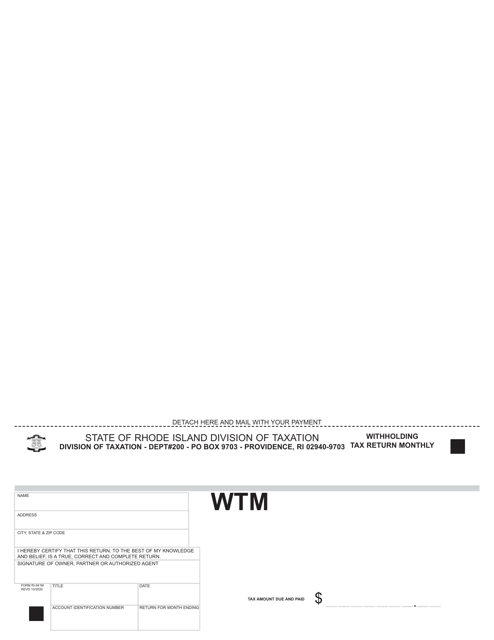

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

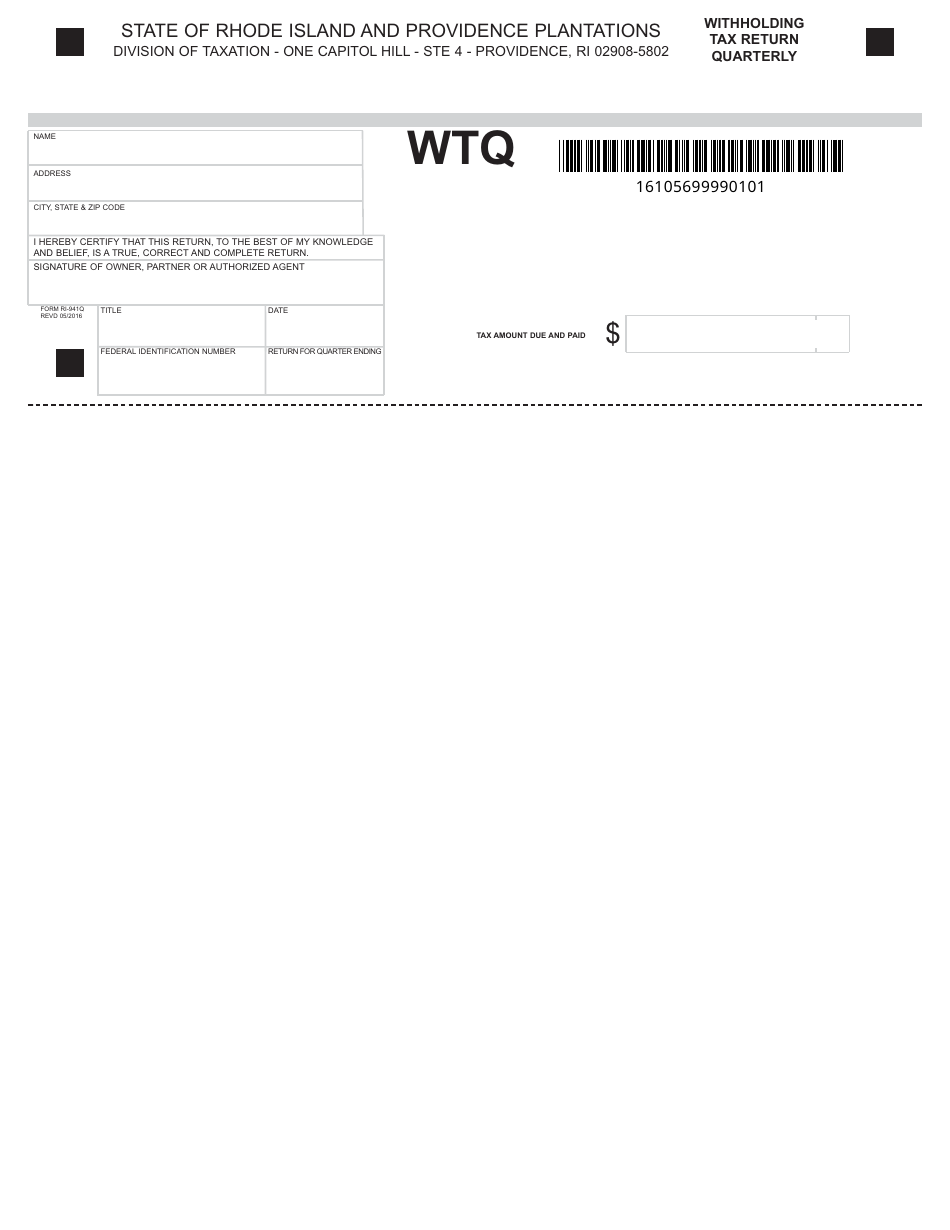

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

Irs Form 945 How To Fill Out Irs Form 945 Gusto

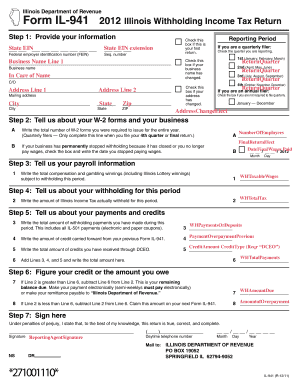

Fillable Online Tax Illinois Tax Withholding Form Fax Email Print Pdffiller

Improved Tax Withholding Estimator Now Available Pg Co

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Ri Ri W 4 2020 2022 Fill Out Tax Template Online Us Legal Forms

State W 4 Form Detailed Withholding Forms By State Chart

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

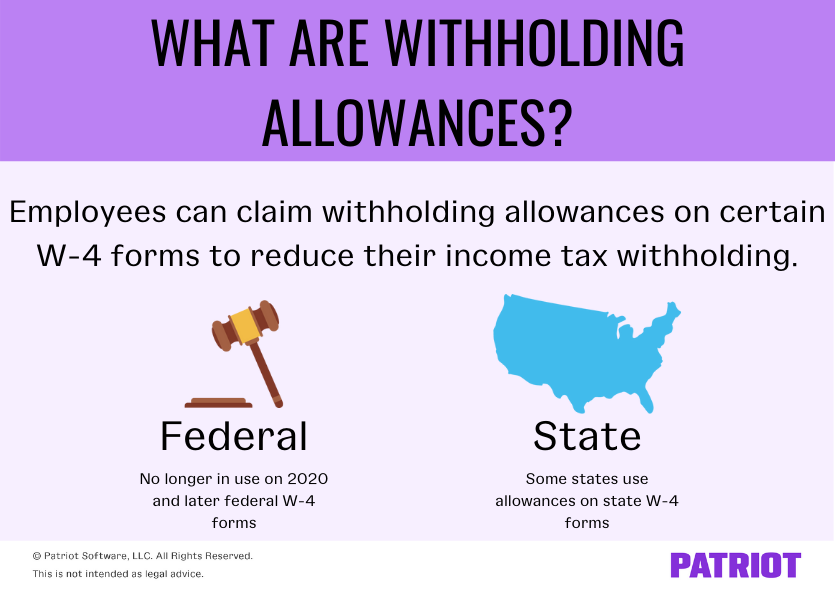

Withholding Allowances Payroll Exemptions And More

Pay Envelope Hoosac Mills New Bedford Massachusetts 1941 New Bedford Massachusetts Fairhaven